Profitable Trading Strategy

Trading Signals vs. Patterns vs. Setups vs. Strategies: Why a Personalized, Profitable Trading Strategy Is All You Need for Consistency https://youtu.be/b6kVakvsl2k We’re going to break

In this video, we will discuss the Human Psychology Conflicts, and the issue of Performance Pressure, which is related to the third secret of professional traders’ success.

As mentioned earlier, the zero-sum game characteristics of trading and the uncertain nature of price’s direction creates significant emotional pressures on market participants.

Although lack of discipline and cognitive biases are generally considered as the root cause of this problem, the study of trading psychologist Dr Brett Steenbarger, pointed out that trading systems.

His research indicated that Traders often assume that their impulsive decisions, which are made out of fear or frustration, are linked to psychological problems.

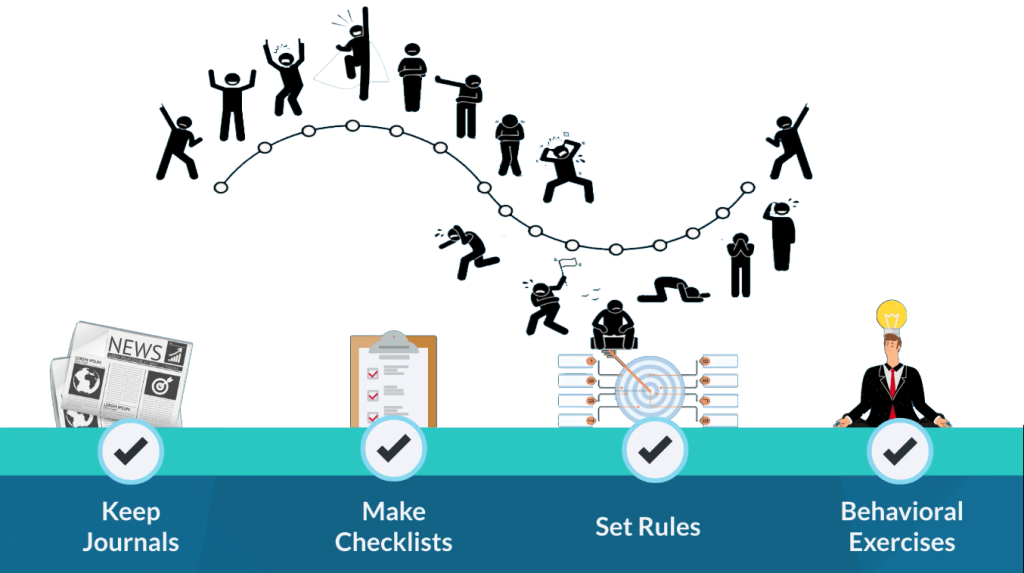

Traders keep journals, make checklists, set rules, and use deliberate practice to become profitable. But to overcome Cognitive/Emotional Mismatches, traders need to take some additional steps.

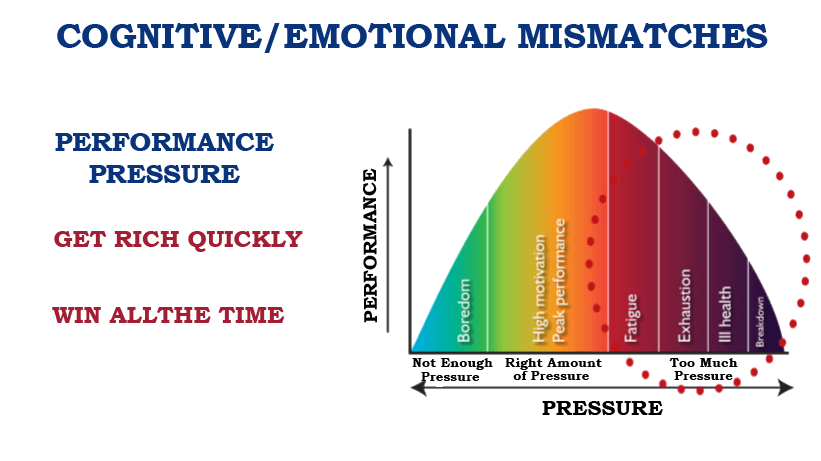

Let’s first understand the three major “Cognitive/Emotional Mismatches”, starting with Performance Pressure. Performance Pressure is a self-imposed mental Pressure novice traders put on themselves. They expect to “get rich quickly”, and to win 100% of the time. The majority of market participants are highly motivated individuals who invested a significant amount of time and effort on market research and analysis. Understandably, they have high hopes that their commitment and investments would result in profit, similar to other businesses.

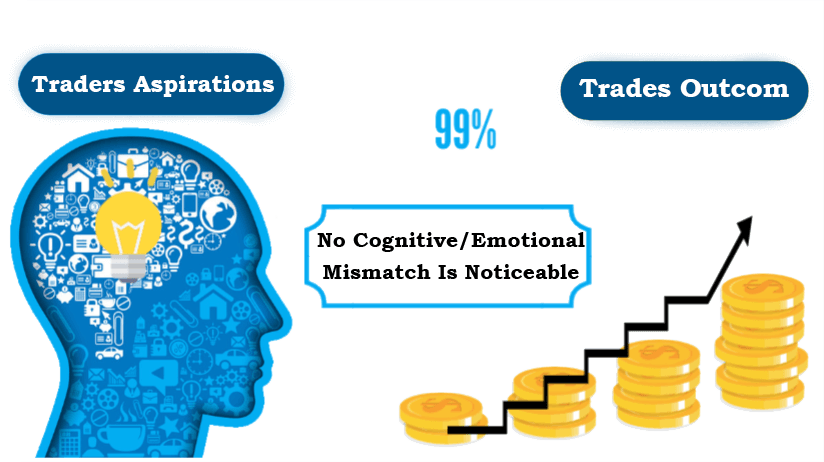

Under desirable conditions, where there is a high winning rate and positive expectancy, there is no conflict between a trader’s aspirations to make profit and the trade’s outcome. As a result, there isn’t a noticeable cognitive/emotional mismatch.

The challenge appears when a trader desires positive results but faces negative outcomes. The pressure to become profitable adversely impacts a trader’s calm, relaxed, and focused mindset, which is vital for the proper execution of a successful trading system.

Due to performance pressure, many traders increase their size and number of trades, which puts them under more stress and risk of loss. Also, many aspiring traders mistakenly have the tendency to force every trade to become profitable. This puts them on a dead-ended path of trying to win all the time- which is statistically impossible.

New traders are often professionals with successful track records in other predictable businesses. They often have a hard time grasping the concept of the “Probabilistic Nature of Trading.”

New traders have to psychologically accept the idea of having manageable small losses before beginning to trade in the markets. If they don’t, they’ll often cut their profits short or blow their trading accounts.

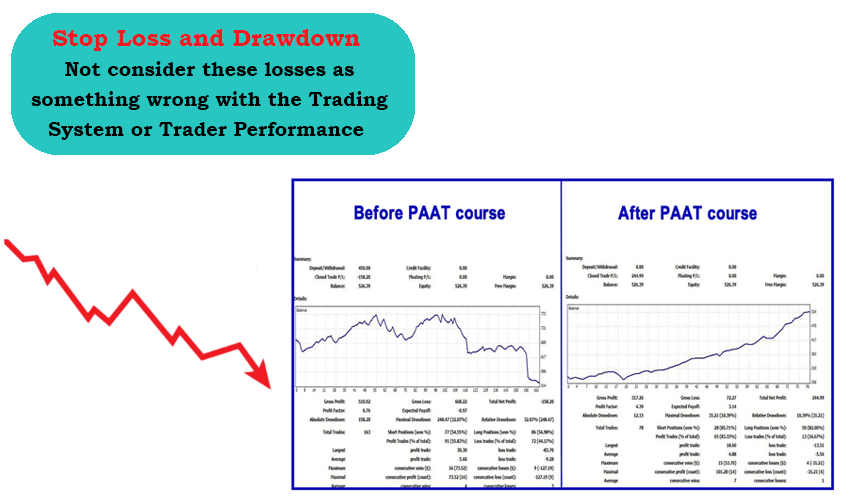

Traders need to understand and fully accept the normal distribution of losses generated from a single or series of trades by their trading systems. They must train their minds to not consider losses as something wrong with their trading, as long they are within the normal distribution range of losses within their trading system.

Overtime, aspiring traders will learn to see the “big picture” perspective of their trading performance and emotionally detach themselves to the outcomes of every single individual trade. So why do so many traders have trouble psychologically tolerating losses, even if they know that it’s a regular part of trading?

To find answers to this question and understand another major cause of emotional/cognitive mismatchs that need to be considered during the design of a profitable trading system, please click on the next video.

Trading Signals vs. Patterns vs. Setups vs. Strategies: Why a Personalized, Profitable Trading Strategy Is All You Need for Consistency https://youtu.be/b6kVakvsl2k We’re going to break

Introduction to Trading Personalization: Understanding its Crucial Role in a Trader’s Success https://youtu.be/c1-0XvoJeLc This lesson of module 12, workshop 34, I will discuss the topic

Advantages of High Probability Trading Setups with High Win Rate https://youtu.be/eBCC3wdOW7Y we will discuss the advantages of a profitable trading system based on a high-probability

RISK DISCLOSURE: Futures, stock, forex, and options trading contains substantial risk and is not suitable for every investor. The information presented on this website and through TradingDrills Academy is for educational purposes only and is not intended to be a recommendation for any specific investment. By using TradingDrills Academy and its products and services, you agree to its Terms of Service and DISCLAIMERS AND LIMITATION OF LIABILITIES. Past performance is not indicative of future results. The risk of loss trading leveraged securities, futures, forex, and options can be substantial and involves risk. Individuals must consider all relevant risk factors including their own personal financial situation before trading. TradingDrills Academy, its teachers and affiliates, are in no way responsible for individual loss due to poor trading decisions, poorly executed trades, or any other actions which may lead to loss of funds. An investor could potentially lose all or more than the initial investment. TradingDrills Academy encourages all students to learn to trade in a virtual, simulated trading environment first, where no risk may be incurred. Students and individuals are solely responsible for any live trades placed in their own personal accounts. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

© 2022 Trading Drills® Academy. All rights reserved.