MetaTrader Trendline Trading ATM

$40.00 – $100.00Price range: $40.00 through $100.00

Trendline Trading ATM: Trade Smarter, Not Harder.

This MetaTrader expert advisor provides the tools for consistent trading success: precise entries, managed exits, and robust risk management. Take control of your trading today and start maximizing your profits!

Try it free for 7 days! Full access to all features. No credit card required.

Upon purchase, you will receive a license key that activates the Expert Advisor on up to 3 accounts (real or demo). This license is valid for your chosen subscription period. It also includes a one-time reset option. This reset allows you to deactivate your current account activations and activate the Expert Advisor on 3 new accounts.

Compatible with both MetaTrader 4 and MetaTrader 5 (MT4 & MT5).

MetaTrader Trendline Trading ATM

Trade with Confidence Using the Trendline Trading ATM (Advanced Trade Management)!

Master entries, exits, and risk management with the powerful tools of the MetaTrader Trendline Trading ATM. This expert advisor equips you with a comprehensive suite of tools to trade consistently smarter, not harder. Take control of your trading risk and drawdown, capture profitable entries, and let your winners run.

This innovative utility empowers you to:

- Precision Entry & Exit: Identify high-probability entry points with dynamic trendline tools and manage trades seamlessly with automated trendline exits.

- Lightning-Fast Order Control: Place, manage, and close all trades with a single click for unmatched efficiency.

- Automated Risk Management: Reduce emotional decision-making by automatically setting Stop Loss and Take Profit levels and calculating trade size based on your risk tolerance.

- Curb Overtrading: Set limits on the number of trades you open to maintain discipline and avoid impulsive decisions.

- Visualize Key Levels: Gain valuable market context with Dominant Range Bars, historical OHLC data, and live profit/loss tracking directly on the chart.

- MT5 Trendline Trading ATM is built by traders, for traders. It simplifies complex tasks and streamlines your workflow, allowing you to focus on making strategic trading decisions.

- Elevate your trading experience. Get MT5 Trendline Trading ATM today!

Introducing the Advanced MetaTrader Trendline Trading ATM Expert Advisor

MetaTrader 4 and 5 are undeniably popular trading platforms offering a robust feature set for most traders. While user-friendly and easy to use, the need for additional functionalities to support evolving analytical strategies and trading styles is ever-present. The MetaTrader Trendline Trading ATM Expert Advisor addresses this need head-on. This advanced tool boasts special capabilities designed to significantly improve your trading efficiency and profitability.

In the following sections, we’ll delve deeper into the features and functionalities of this powerful MT Utility and or Advanced Trade Management.

Various advanced features of MT5 Trendline Trading ATM:

In the following sections, we’ll delve deeper into the features and functionalities of this powerful MT Utility and or Advanced Trade Management.

- Enhanced Trading Entry Points:

- Improve entry points by analyzing price reversals and dynamic trend line breaks.

- Efficient Trade Management:

- Manage and exit trades opened by dynamic close trendlines effectively.

- Streamlined Order Placement:

- Place and manage limit orders using customized keyboard shortcuts.

- Quick Trade Execution:

- Close all trades with a single button, simplifying the process.

- Delete all orders instantly when needed.

- Risk Management Automation:

- Automatically set Stop Loss and Take Profit levels for all positions and orders on the chart.

- Optimized Trade Volume Calculation:

- Calculate the correct trade volume based on the trader’s risk level.

- Prevent Over Trading:

- Limit the number of trades to maintain discipline.

- Visual Insights:

- Display the Dominant Range Bar based on trader-defined values.

- Show OHLC (Open, High, Low, Close) levels from previous days’ candles as static support and resistance.

- Real-Time Profit and Loss Monitoring:

- View daily and momentary profit and loss directly on the chart.

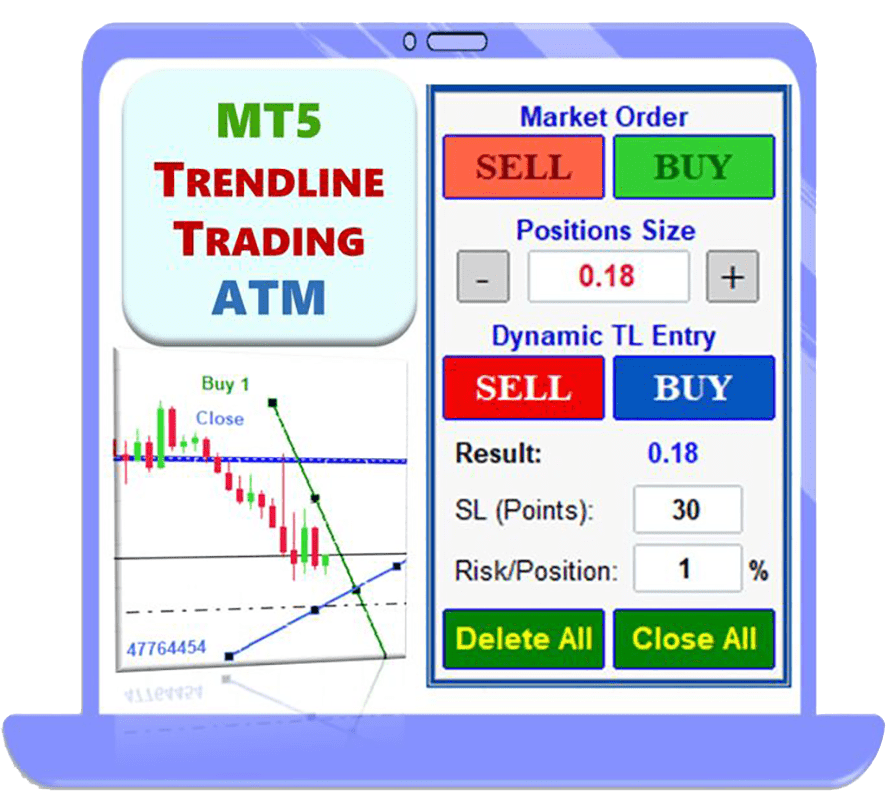

The following photo shows an image of the chart environment after adding the MetaTrader Trendline Trading ATM tool.

This guide explains the various sections and capabilities of the MetaTrader Trendline Trading ATM Expert panel displayed on your chart after installation (as shown in the image).

Section 1: Manual Order Entry

- Buy/Sell Buttons: Open trades at the current market price with adjustable volume (set in Section 2).

- Dynamic Trendlines: Positions opened here will have an associated trendline for automated exit management.

Section 2: Volume Adjustment

- Volume Control: Adjust the volume for all orders and positions executed by the expert.

- Initial Volume: Defaults to the minimum allowed volume for the current symbol on your chosen broker.

- Volume Rounding: Entered volumes may be rounded to the nearest acceptable value.

- Volume Buttons (+/-): Easily adjust the desired volume.

Section 3: Trendline Entry

- Buy/Sell Buttons: Similar to Section 1, but allows user-drawn dynamic trendlines for automated entry.

- Trendline Activation: Positions open upon specific chart conditions (e.g., breaking the trendline).

- Dynamic Trendlines: Trades opened here will also have a trendline for exit management.

Section 4: Risk-Based Volume Calculator

- Advanced Calculator: Calculates the trade volume based on your desired Stop-Loss (SL-Points) and risk percentage per trade (Risk/Position).

Section 5: Order Management

- Delete All Button: Removes all unfilled orders sent to the broker.

- Keyboard Shortcut (Shift + Up): Quickly delete all orders using a keyboard shortcut (customizable in settings).

- Order Scope: Selectable deletion of orders (current symbol only or all broker symbols).

Section 6: Position Management

- Close All Button: Closes all open positions.

- Keyboard Shortcut (Shift + Down): Quickly close all positions using a keyboard shortcut (customizable in settings).

- Position Scope: Selectable closing of positions (current symbol only or all active symbols).

Section 7: Dominant Range Bar Display

- Location and Display: This section clarifies where and how the Dominant Range Bar (a visual tool) appears on your chart.

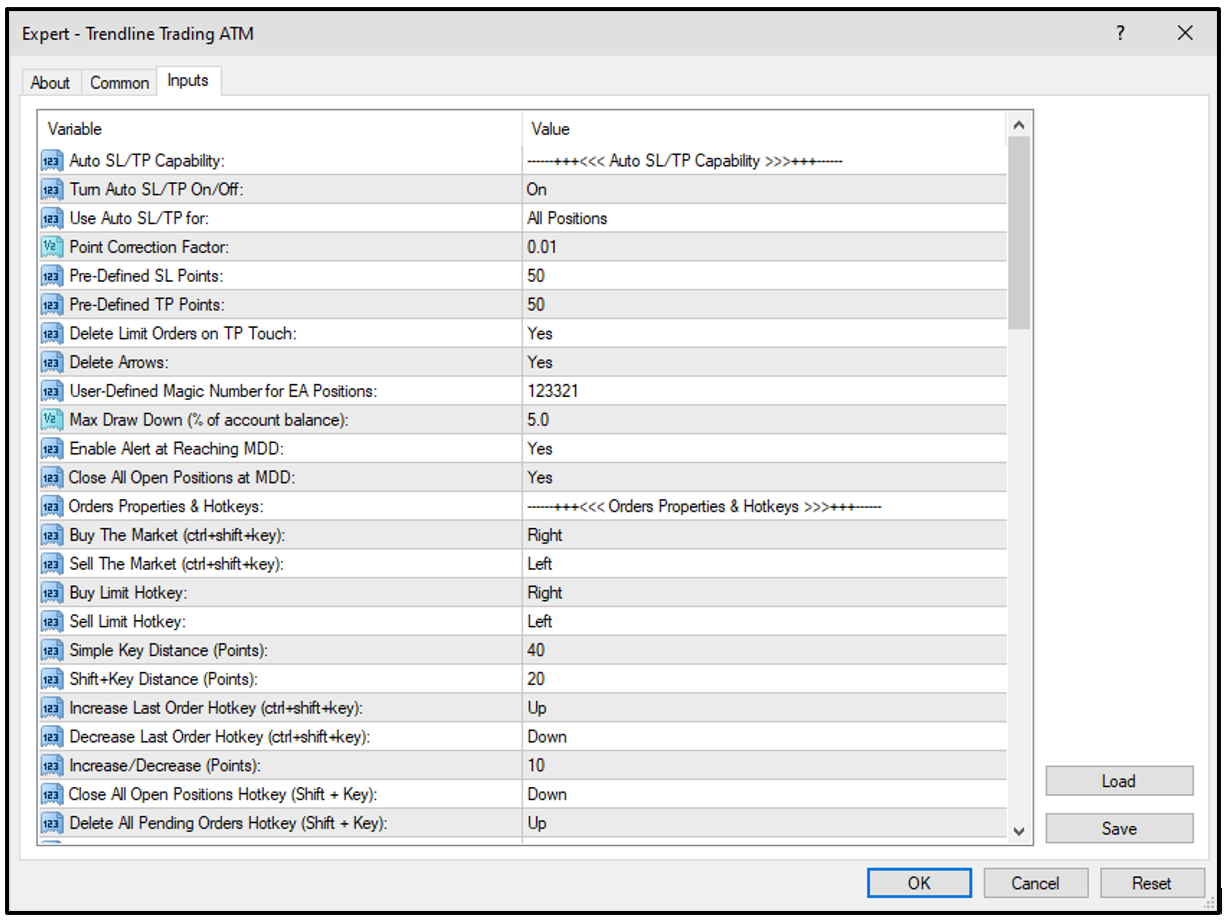

Trendline Trading ATM Tool Settings (Inputs):

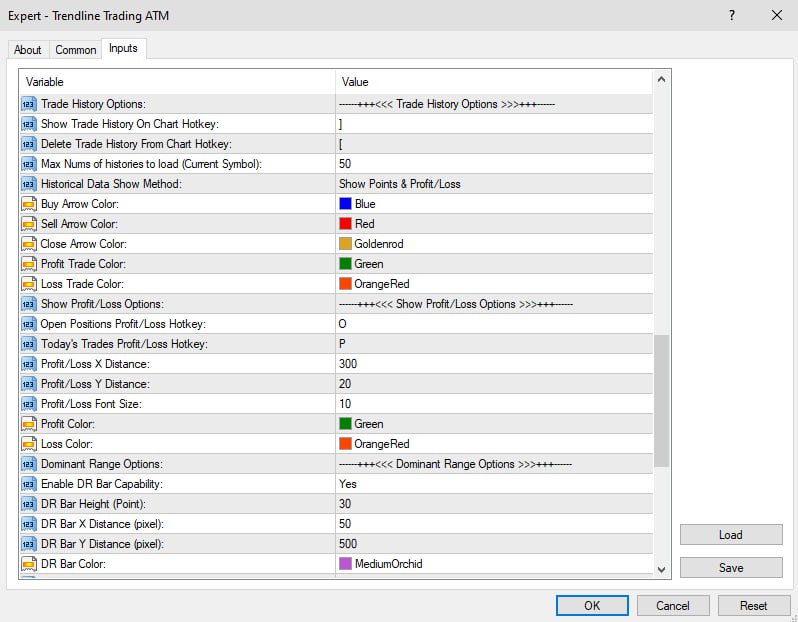

As shown in the figure below, Trendline Trading ATM has various input sections. We’ll explain each of them in the following.

Auto SL/TP Settings

This section controls automatic Stop Loss (SL) and Take Profit (TP) placement on the chart. You can:

- Enable/disable automatic SL/TP

- Choose which order types receive automatic SL/TP

- Adjust the Point Correction Factor: This accounts for differences in “Point Values” of various trading instruments. For example, if a 50-point SL on your platform translates to 5000 points on the chart, enter a Point Correction Factor of 0.01.

- Set default SL and TP values

- Enable/disable deleting limit orders after the price reaches the order’s profit target (TP)

- Define a Magic Number: This unique identifier distinguishes Trendline Trading ATM from those of other experts, especially in the MetaTrader Strategy Tester.

- Set maximum draw down limit (MDD) based on percent of account balance.

- Enable/disable alert and auto close positions at reaching MDD.

Pending Orders & Hotkeys

Customize keyboard shortcuts for:

- Open new buy long or sell short positions at the market current price

- Placing limit orders near or far from the market price (with or without Shift key)

- Adjusting order entry price (moving orders up/down)

- Delete All and Close All functions.

Available shortcuts include numbers (0-9), letters (A-Z), and arrow keys.

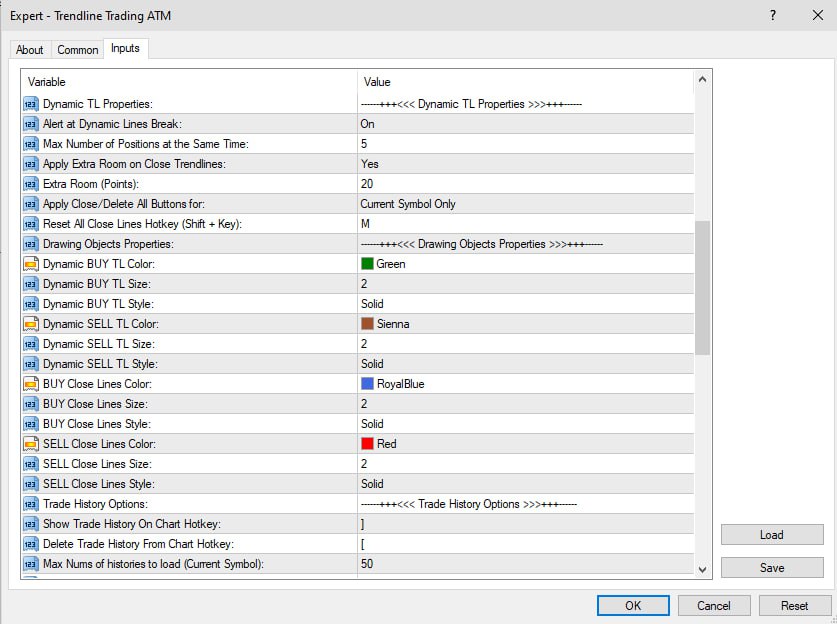

Dynamic Trendline Properties

- Trendline Alarms: Enable/disable alarms for positions opened by dynamic trendlines (plays every 5 seconds, user-dismissible by clicking).

- Maximum Trades: Set the maximum number of trades Trendline Trading ATM can open simultaneously.

- Extra Room: This setting creates a buffer zone around dynamic trendlines. Price movement within this zone won’t trigger entry or exit signals. Define the buffer size in points.

- Delete All/Close All Scope: Choose whether these functions apply to the current chart symbol only or all active symbols.

- Reset All Close Lines: Set a hotkey to reset all dynamic close lines (which have been unintentionally removed from the chart).

Drawing Object Properties

Customize the appearance of trendlines on your chart, including:

- Color

- Thickness

- Line style (separate styles for buy/sell and closing lines)

Trade History Options (MT4 Only)

Since MT5 already displays trade history graphically, these settings are only relevant for the MT4 version of Trendline Trading ATM Expert.

- Enable/Disable Trade History: Use the keyboard shortcuts “]” (show) and “[” (hide) to toggle trade history visibility on the chart.

- Customize Trade History Display: Adjust the number of displayed trades, profit/loss display (points or dollars), and color schemes for entry/exit points and profitable/losing trades.

Show Profit/Loss Options

This section controls the display of profit/loss (P/L) information:

• Enable/Disable P/L Display: Use the keyboard shortcuts “O” (current P/L) and “P” (daily P/L) to toggle visibility.

• Customize P/L Display: Adjust the location, font, and color of P/L information on the chart.

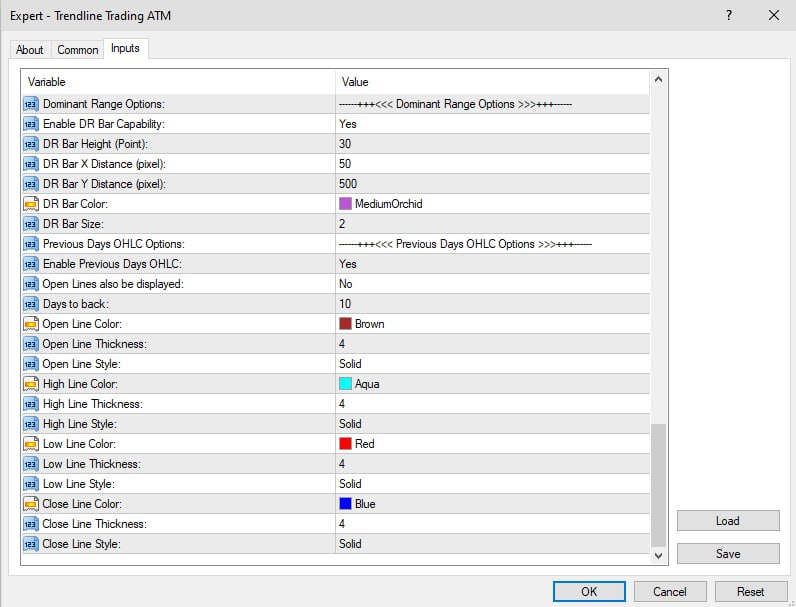

Dominant Range Bar

• Enable/Disable Display: Activate or deactivate the Dominant Range Bar on the chart.

• Customize Appearance: Adjust the bar’s height, location, color, and thickness.

Previous Days’ OHLC

• Enable/Disable Display: Show or hide the Open, High, Low, and Close (OHLC) levels of previous days on the chart.

• Customize Appearance: Choose which OHLC levels to display, the number of days back to consider, and the color, size, and line style.

Master the art of trading with the Trendline Trading ATM expert! The Trading Drills Academy equips you with not only the knowledge to navigate different financial markets and develop winning strategies, but also the expertise to leverage the advanced Trendline Trading ATM tool. This powerful utility helps you pinpoint ideal entry and exit points, maximizing your profit potential.

Disclaimer:

Trading financial markets carries significant risk. Price movements are probabilistic and do not guarantee future profits. The Trading Drills Academy and its affiliates are not responsible for your trading or investment results.

All trading strategies and software provided are for educational purposes only and should not be considered financial advice or a substitute for your own judgment.

While information regarding price charts is obtained from sources believed to be reliable, we cannot guarantee its completeness, accuracy, or the results of using this information.

The decision to utilize trading strategies, indicators, or expert advisors rests solely with you. You are responsible for evaluating their suitability for your needs and risk tolerance.

Before making any trading decisions, consult with your broker to understand the specific risks involved in your chosen markets.

Related products

-

Price Action Algo Trading (PAAT) – Premium Entire Course

$300.00 – $870.00Price range: $300.00 through $870.00 Select options This product has multiple variants. The options may be chosen on the product page -

Private Trading Coaching

$197.00 – $788.00Price range: $197.00 through $788.00 Select options This product has multiple variants. The options may be chosen on the product page