Master Consistency: Build Your Personalized Trading Strategy (Beat Signals, Patterns, Setups)

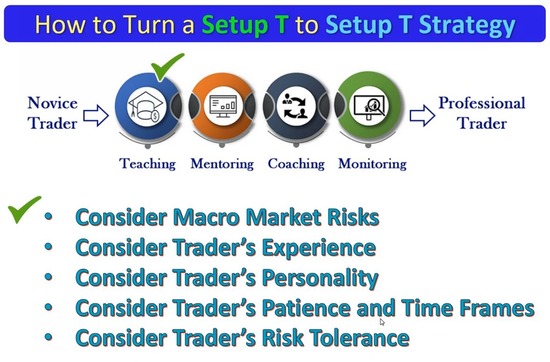

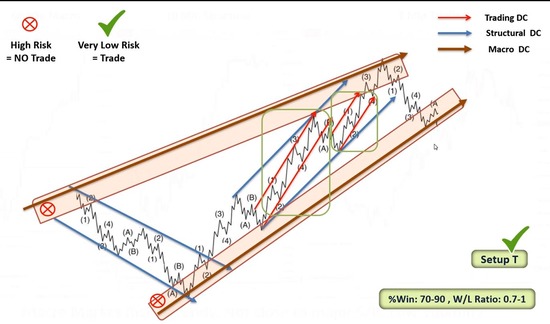

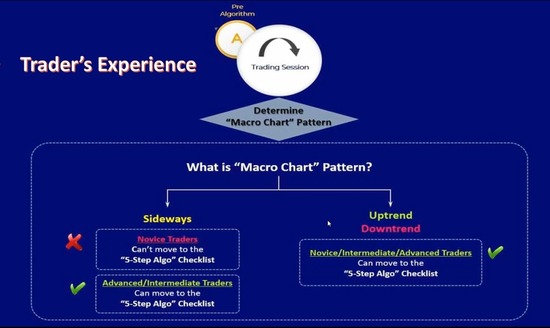

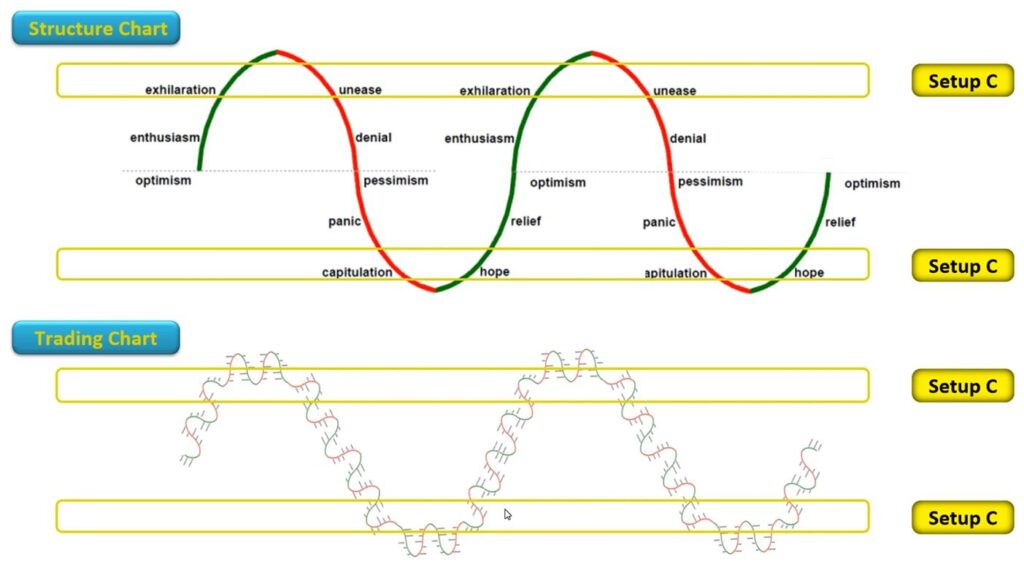

Master Consistency: Build Your Personalized Trading Strategy (Beat Signals, Patterns, Setups) https://www.youtube.com/watch?v=b6kVakvsl2k&list=PLNdkLl_SbhT0q9xpFhLkKbjQ0LiowjCYD&index=3 This blog post dives into the world of trading terminology, clearing up confusion