Standard Swing High And Swing Low

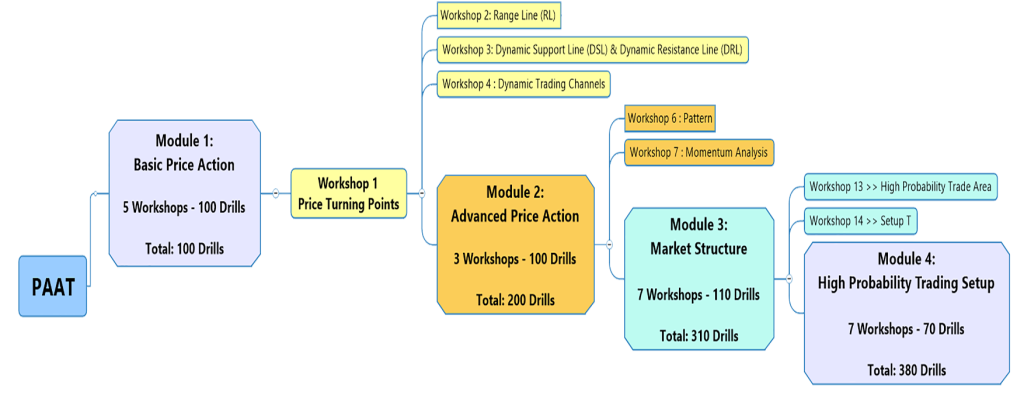

In Module 1, workshop 1, we discuss the topic of Price Turning Points.

As mentioned earlier, the markets are an open auction environment evolved to facilitate trading. Market participants are constantly betting against each other to determine the fair value price of a financial instrument. This creates buying or selling pressure, which subsequently moves the price of traded financial instrument. The cumulative decisions of these collective human beings determine the market’s price direction.

Since market participants have various degrees of investments, risk tolerance, and short- to long-term reward expectations and sentiments, this makes the price movement to exhibit a wave shape pattern and each wave cycle is repeated throughout different time frames, similar to fractal patterns seen in nature.

This crowd psychology makes the market a live emotional entity and its mood represents the collective emotional feelings of all its participants. The market participants enter into the greed phase when the price is rising, and the fear phase when the price is falling. Due to a lack of training, many aspiring traders are not prepared to recognize and respond properly to the changes in phase of the market at these turning points. The emotional-cognitive mismatches add up to the issue!

Price turning points define advanced price action, market structure, high probability trading setups, and the best price entry areas, which will all will be discussed in detail in upcoming modules.

Swing High and Swing Low:

If we look at one single wave of price, also known as a SWING, it is made of two turning points. The price that is going up reach its highest level at a PEAK, before reversing down. The highest reversal turning point on the chart is defined as ‘Swing High’, which is abbreviated as SH.

The price that is going down reach its lowest level at a TROUGH, before reversing up. The lowest reversal turning point on the chart is defined as ‘Swing Low’, which is abbreviated as SL.

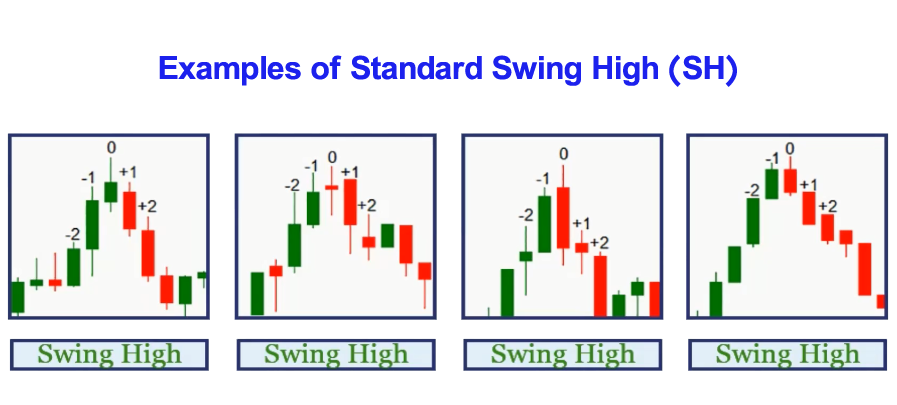

Use These Three Simple Steps to Identify any Swing High Quickly:

- Find the Peak candle.

The Peak candle is the one that has the highest high amongst all other candles. Then mark the Peak candle, as Zero. - Mark the 2 candles before the zero candle as -1, and -2.

And after zero candle as +1 and +2 accordingly. - If the ‘High’ of these four candles are sequentially lower than the High of zero Peak candle, you identified a standard Swing High (SH).

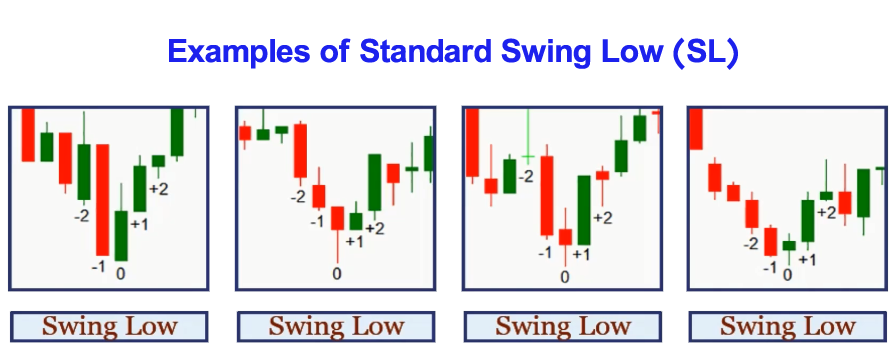

Use These Three Simple Steps to Identify any Swing Low Quickly:

- Find the TROUGH candle.

The TROUGH candle is the one that has the Lowest Low amongst all other candles. Then mark the TROUGH candle, as Zero. - Mark the 2 candles before the zero candle as -1 and -2.

And after zero candle as +1 and +2 accordingly. - . If the ‘Low’ of these four candles are sequentially higher than the Low of zero Trough candle, you identified a standard Swing Low.