Our Success Secrets

At Trading Drills Academy, we recognize that trading is a high-performance skill-based career. We acknowledge the common traits shared by top traders and professionals in fields such as athletics, aviation, music, art, medicine, and other elite high-skill performances.

Unfortunately, many trading courses only teach theory and trading strategies through books, videos, and webinars. They don’t give traders enough practical drills or chances to apply what they’ve learned in real trading situations. It’s like trying to become a pilot or athlete just by reading books or watching videos. And also watching others trade or being in a live trading room won’t help develop the skills needed because someone else is making the decisions.

With over 20 years of experience in trading, training, and research on high-performance skill development, we have developed a comprehensive solution that includes Teaching, Mentoring, Coaching, and Monitoring based on the Deliberate Practice concept with numerous Smart Drills. Our solution includes all the key elements of developing competencies and essential trading skills to turn a novice trader into a professional.

The path to success in trading depends on two factors:

1. Professional Trader’s Mindset/Attitude: The trader should understand the true nature of the trading business and be fully prepared to invest in developing a high level of competency to develop the skills required for success in trading.

2. Training System Based on High-Performance Skill Development: Traders should find a training/coaching system designed for high-performance skill development, which can help transform a novice trader into a professional-level trader.

(1) Professional Trader’s Mindset/Attitude

Many aspiring traders hold a misconception about trading, believing it to be comparable to traditional academic disciplines. They assume that by taking a course, obtaining a degree, and following a predefined path, they can enter the trading world and achieve consistent income. This misconception, often referred to as the “Illusion of Expertise,” is rooted in the belief that their prior educational experiences have instilled in them: the idea that “Knowledge is a Commodity.” As a result, these traders continually search for more knowledge, hoping to discover a holy grail strategy. They mistakenly think that once they understand how the system works, they can execute trades professionally and achieve success. All aspiring traders who aim for success must let go of the illusion of an expertise mindset and truly grasp the essence of trading as a high-performance career, comparable to that of professional athletes, musicians, artists, physicians, and other esteemed professions.

The findings of over 100 prominent scientists, compiled in The Cambridge Handbook of Expertise and Expert Performance, consistently demonstrate that experts are developed rather than born and reached the following conclusions:

- There is no correlation between IQ and expert performance in high-performance domains

- Success is correlated with intensive practice, guidance from dedicated mentors, and support from family and friends

- Experts are developed through deliberate practice over time

- Deliberate Practice involves tackling tasks beyond current competence and comfort levels

- Having a knowledgeable coach is crucial for optimal progress and self-coaching ability

Therefore, please watch these videos to find answers to important questions that will help you develop a skill-oriented mindset and attitude, essential for your investment in training and success in trading.

- What percentage of people succeed in trading?

- Do you need a high IQ and a lot of knowledge to succeed in trading?

- Is spending a long time in any profession enough for success?

- What is “Deliberate Practice” and how can Smart Drills help traders?

- What are the characteristics of a profitable trading system?

- Why is learning the process and algorithmic conditions of a profitable trading system important?

- Why do many fail to become consistently profitable traders?

- What is the role of Process and Conditional knowledge in skill-based training in trading?

- Why mastering the execution of a profitable system is important in trading?

- How can Smart Drills under Learning Management System help to develop trading skills?

- How to reverse engineer a trading system/plan to prepare traders for the three Human and Market Cognitive Emotional Mismatches?

- What are the conflicts between Human Psychology and Market Psychology?

- Why do so many traders struggle to accept losses as a natural part of their trading system, leading to small losses growing larger and out of hand?

- How can Loss Aversion be mitigated by utilizing a trading system with a high win rate, enabling traders to more readily accept losses, manage their risk-taking behaviors, and navigate the challenges associated with loss aversion?

What percentage of people succeed in trading?

Why do many fail to become consistently profitable traders?

Is spending a long time in any profession enough for success?

Do you need a high IQ and a lot of knowledge to succeed in trading?

What are the “Cycle of Excellence” and “Deliberate Practice” and how can they help traders?

What is the role of Process and Conditional knowledge in skill-based training in trading?

What are the characteristics of a profitable trading system?

Why is learning the process and algorithmic conditions of a profitable trading system important?

How can Smart Drills under Learning Management System help to develop trading skills?

What are the conflicts between Human Psychology and Market Psychology?

How to reverse engineer a trading system/plan to prepare traders for the three Human and Market Cognitive Emotional Mismatches?

Human-Market Psychology Conflicts and Cognitive Emotional Mismatches - Loss Aversion

How does the illusion of expertise impact the decision-making process and trading strategies of individuals in the financial markets?

What are the various levels of competencies in trading, and why is it crucial to develop second-order competency through deliberate practice?

Why a Personalized, Profitable Trading Strategy Is All You Need for Consistency?

The Three Essential Trendline Trading Strategies that You Need to Consistently Trade Any Market

Master Prop Trading: The Successful Prop Trader's Insider Secrets For Consistent Profits and Payouts

What is the Price Action Trading and Its Advantages?

What are the advantages of High Probability Trading Setups with High Win Rate?

Introduction to Trading Personalization: Understanding its Crucial Role in a Trader's Success, as covered in Module 12 and Advanced PAAT, and during the Initial Coaching Session.

(2) Training System Based on the High-Performance Skill Development

- How to create a successful training system for High-Performance Skills such as trading?

- What mechanisms should be used to increase training efficiency and the chances of success in trading?

- What are the most effective ways to transform a novice trader into a professional trader?

All of these questions were, in fact, part of the challenges we faced when starting the TradingDrills Academy. This led us to extensive research on the subject of deliberate practice and the development of competencies for success in trading as a high-performance career. We have developed a comprehensive solution that includes all key elements of developing competencies to transform a novice trader into a professional trader, based on the following training process:

Teaching

The primary focus of our teaching approach is to transfer Content, Process, and Conditional Knowledge through both preliminary and advanced workshops. Our teaching concepts have been carefully designed with the principles of simplification, ensuring that only practical theories essential for skill development are presented. As a result, any non-practical concepts, confusing jargon, or information that hindered decisive action by traders were eliminated. This streamlined approach can be observed in the first 33 workshops, which consist of over 60 animated clips. These concise and clear animations elucidate the practical applicable concepts and theories underlying the dynamic pure price action and algorithmic decision-making process of the PAAT system.

Furthermore, our teaching materials adhere to the principles of Deliberate Practice, which are managed and presented through a Learning Management System (LMS). The materials begin with basic concepts of dynamic price action, gradually increasing in difficulty as students progress to more advanced workshops that delve into complex concepts related to the processes, algorithms, and personalization of the PAAT system. Our LMS system ensures that all requirements for deliberate practice are met, providing constant monitoring and supervision for students. To progress through the program, students must complete each level in the correct sequence and pass evaluations, including multiple exams.

Mentoring

Mentoring is a training process that involves a relationship between an experienced individual, known as the “mentor,” and a less experienced individual, referred to as the “mentee.” The purpose of this relationship is to share knowledge, experience, and advice with the aim of facilitating professional and personal development.

Mentoring holds a special and significant role within the training system of TradingDrills Academy. Our senior instructors, who have amassed extensive experience in various global markets, trading systems, and have faced numerous technical, psychological, and risk management challenges on their path to trading consistency, serve as trusted advisers and role models.

Our mentors provide daily support to traders by answering questions related to the content, process, and conditional knowledge received through the LMS system and during live webinars. They play a vital role in expediting the professional growth of students by consistently monitoring their educational progress using the LMS system and offering practical skill development suggestions.

All of our instructors have actively participated in the development and update of 760 Smart Drills, which are in the form of practice sessions and exams conducted using live market charts. These Smart Drills provide instant feedback and interactive assistance in developing the skill sets defined by the learning objectives of each module or workshop. Our mentors are available to address any questions or concerns related to completing the practice drills. They understand that completing a large number of drills as part of deliberate practice can be challenging, and they encourage students to stay focused, be patient, and remain resilient in order to navigate the initial learning curve of skill development with the least amount of time and energy, while maximizing productivity.

Coaching has been proven to have a significant and positive impact on self-confidence, well-being, and work performance, making it an essential component in achieving mastery of high-performance skills such as trading. In this process, coaches help individuals become more aware of their potential and innate abilities instead of simply instructing them. The coach-student relationship is characterized by dialogue and comprehensive cooperation, with the coach serving as a facilitator, encouraging deep introspection to uncover one’s unique potential and maximize personal and professional abilities.

As mentioned earlier, the third element of success in trading involves personalizing all variables of a profitable trading system to align with the trader’s psychology and lifestyle. With years of training and experience in conducting private coaching sessions, our senior instructors work closely with students who have completed the PAAT course to identify these personal variables, as outlined in detail in Module 12.

Our senior instructors have devised specific coaching processes that address all essential innate personal variables influencing trading success. During the initial coaching session, we conduct interviews with clients to raise their self-awareness about variables such as the ideal trading session to focus on, trading style, cognitive processing speed, risk tolerance, dollar loss tolerance, performance pressure, the illusion of expertise, and other psychological factors. Based on this information, we offer tailored suggestions on the best time frames, trading setups, exit strategies, underlying derivatives, risk management techniques, trading software/data, broker selection, and additional strategies for developing technical trading skills that are most suitable for each individual.

In subsequent coaching sessions, we review clients’ trading journals, analyzing their entries and providing suggestions on how to align profitable PAAT system algorithms and the Trading Plan with their psychology and personal variables.

Monitoring

Monitoring is another crucial component in the journey toward mastering trading as a high-performance skill. It involves systematically measuring individual performance by setting clear goals and predetermined criteria for evaluation. Extensive scientific studies and research have demonstrated that individuals who commit to reporting their progress to someone else perform up to 243% better compared to those who pursue their goals alone.

The significant improvement is attributed to an increased sense of commitment to change and improvement in the presence of a coach as an observer. Hence, our experienced coaches not only assist novice traders in personalizing the PAAT trading system to achieve consistency but also play a vital role in monitoring the trader’s performance, discipline scores, and adherence to risk management as they progress towards a higher level of professionalism.

Workshop 36 of our PAAT training program provides comprehensive guidance on preparing a Trading Journal for future monitoring. This workshop covers the process of recording trade results and following checklists aligned with the PAAT trading plan. During monitoring sessions, our coaches review traders’ journals to evaluate progress, identify the need for additional training and exercises, suggest strategies for performance improvement, and address any technical or psychological uncertainties. Monitoring sessions enhance traders’ focus and transparency, prevent major mistakes, prepare traders to handle crises, identify new opportunities, and enhance overall performance and profitability.

Therefore, monitoring complements the coaching process by fostering a sense of commitment and transparency among traders. It enables strategic planning at a high level to maximize efficiency and productivity. Continuous investment in monitoring ensures that individuals make the most of their time and talent on the path to becoming professional traders.

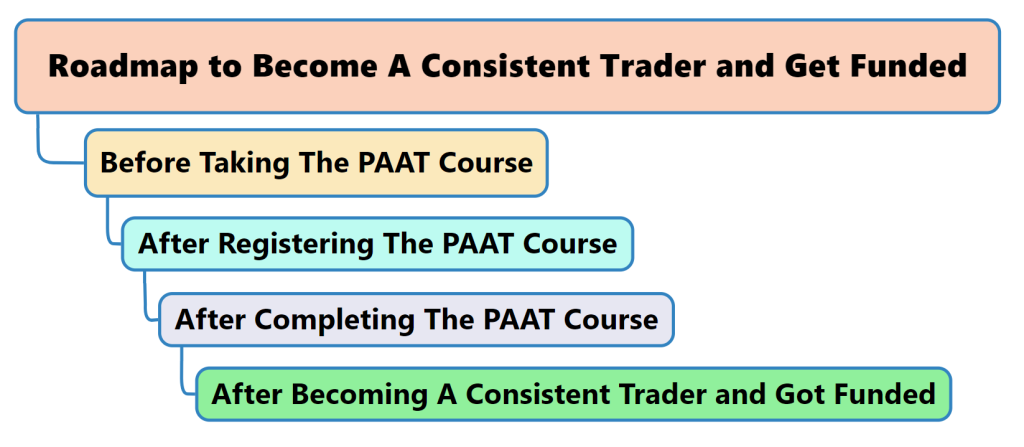

Roadmap to Become A Consistent Trader and Get Funded

Becoming a consistent trader and obtaining funding is a goal for many aspiring traders. To achieve this, it is essential to have a well-defined roadmap that outlines the necessary steps and strategies. In this discussion, we will cover the critical elements of a roadmap to help you become a consistent trader and secure funding for your trading endeavors when you choose to work with us.