Momentum Slope Analysis

In this lesson of chapter 11, we will discuss the concept and process of utilizing Momentum Slope Analysis.

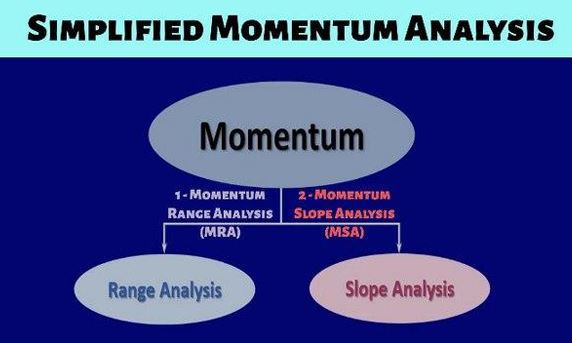

As mentioned earlier, we have streamlined our price action momentum analysis into two methods. In this lesson, our primary focus will be on the second method, Momentum Slope Analysis (MSA).

The concept of MSA is centered around utilizing the slope of dynamic support or resistance lines to assess momentum in a given market.

The process of conducting MSA can be summarized in three straightforward steps:

1. Ensure that the dynamic channel displays an established uptrend or downtrend pattern.

2. Compare the last two consecutive dynamic supports in an uptrend or dynamic resistances in a downtrend pattern.

3. Analyze momentum by examining the change in slope between the last two dynamic supports or resistances. This change can indicate no change in

momentum, increased momentum, or decreased momentum.

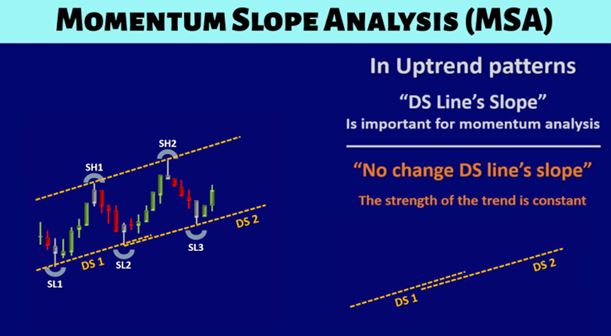

Momentum Slope Analysis in Uptrend Let’s consider a price chart that exhibits a dynamic channel with a well-established uptrend pattern. In this scenario, we will draw the last two consecutive dynamic support lines and compare their slopes, as illustrated below:

In the above example, we observe that the slope of the last dynamic support line (DS2) has remained the same compared to the previous one (DS1), indicating no change in price momentum. When there is no change in the DS line’s slope, it indicates that the upward momentum in the market is stable, and there are no significant shifts or weakening in the trend’s strength. Traders can interpret this as a positive sign, indicating a sustained and robust uptrend.

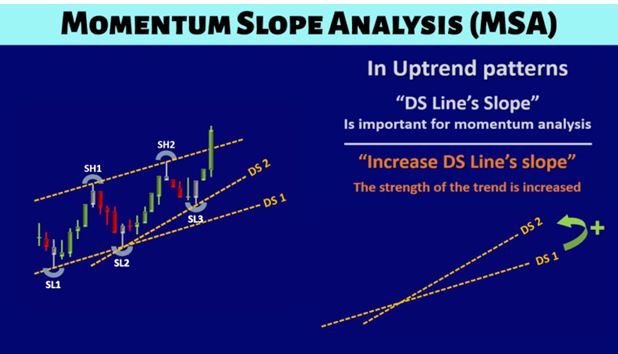

Let’s consider another example of a price chart displaying a dynamic channel with an established uptrend pattern. In this scenario, we will draw the last two consecutive DS lines and compare their slopes, as illustrated below:

In the above example, we observe that the slope of the last dynamic support (DS2) line has increased compared to the previous one (DS1), indicating an increase in price momentum and strengthening of the uptrend.

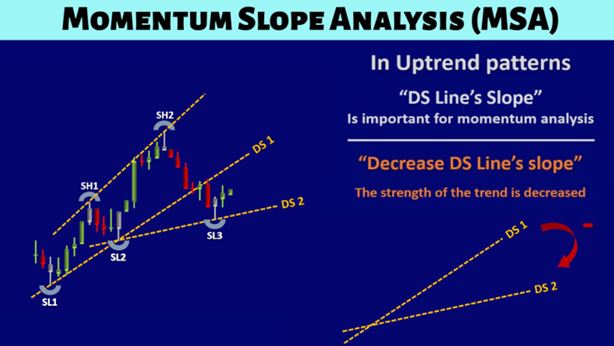

Let’s consider another example of a price chart displaying a dynamic channel with an established uptrend pattern. In this scenario, we will draw the last two consecutive DS lines and compare their slopes, as illustrated below:

In the above example, we observe that the slope of the last dynamic support (DS2) line has decreased compared to the previous one (DS1), indicating a decrease in price momentum and a weakening of the uptrend.

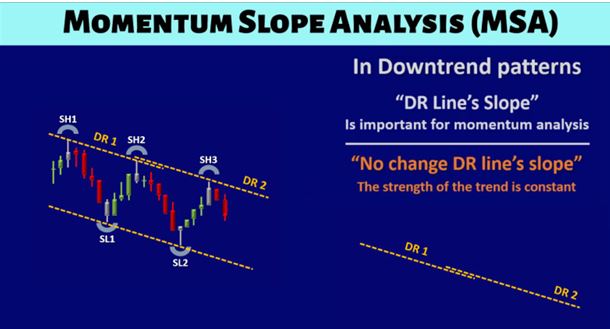

Momentum Slope Analysis in Downtrend Let’s consider a price chart that exhibits a dynamic channel with a well-established downtrend pattern. In this scenario, we will draw the last two consecutive dynamic resistance lines and compare their slopes, as illustrated below:

In the above example, we observe that the slope of the last dynamic resistance line (DR2) has remained the same compared to the previous one (DR1), indicating no change in price momentum. When there is no change in the DR line’s slope, it indicates that the downward momentum in the market is stable, and there are no significant shifts or weakening in the trend’s strength. Traders can interpret this as a positive sign,

indicating a sustained and robust downtrend.

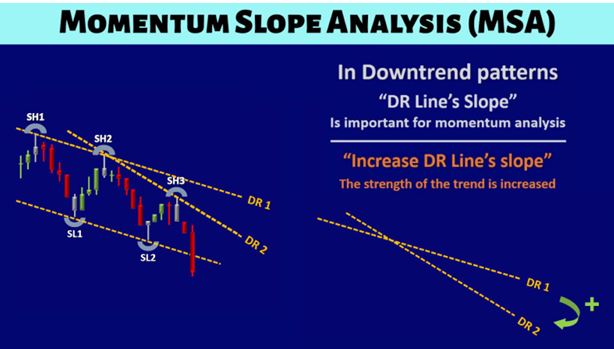

Let’s consider a price chart that exhibits a dynamic channel with a well-established downtrend pattern. In this scenario, we will draw the last two consecutive dynamic resistance lines and compare their slopes, as illustrated below:

In the above example, we observe that the slope of the last dynamic resistance (DR2) line has increased compared to the previous one (DR1), indicating an increase in price momentum and strengthening of the downtrend.

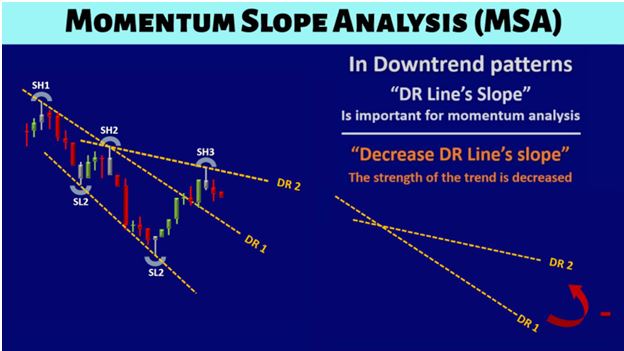

Let’s consider a price chart that exhibits a dynamic channel with a well-established downtrend pattern. In this scenario, we will draw the last two consecutive dynamic resistance lines and compare their slopes, as illustrated below:

In the above example, we observe that the slope of the last dynamic resistance (DR2) line has decreased compared to the previous one (DR1), indicating a decrease in price momentum and a weakening of the downtrend.

You have become familiar with the concept of Momentum Slope Analysis and the process to quickly utilize MSA to analyze the momentum of any price chart in an established uptrend or downtrend.

Please allocate dedicated time to practice this concept and process by utilizing forward testing, market replay, and live demos to acquire these essential PAAT skills necessary

for your success in trading.